QPP – The Quality Payment Program

What is QPP?

As of January 1st, 2017 the Centers for Medicare and Medicaid Services (CMS) required all Medicare and Medicaid providers meeting the participation criteria to report certain data as part of the Quality Payment Program (QPP). The overall purpose of QPP is for CMS to monitor the quality and comprehensiveness of treatment being given to Medicare and Medicaid patients, with an end toward patients getting the best Government-funded care possible. To encourage participation, CMS offers providers financial incentives for compliance, and levies penalties for non- or under-compliance. The way it works is, the more comprehensive the reporting and the more information reported about thorough care and improvements in care, the higher the incentive. QPP pays best for value of care over volume.

Note that these rewards and levies affect future payment for claims only; there is no separate method of reward or levy beyond that.

History

This program replaced the previous mandatory reporting programs Meaningful Use (MU) and the Physician Quality Reporting System (PQRS). As of 2017 this change created one comprehensive reporting system and consolidated the disparate incentives and penalties associated.

How It Works

There are four phases to QPP participation:

- Collecting of data – Practices record various kinds of data, such as patient treatment information and how the practice used technology to support and improve their treatments.

- Reporting of data – Practices send in this data to CMS. This process is called Attestation.

- Receiving CMS feedback – CMS provides feedback to these practices on their level of performance.

- Payment adjustment – Based on the results, the practice receives either positive or negative payment adjustments in the second year following the measurement period.

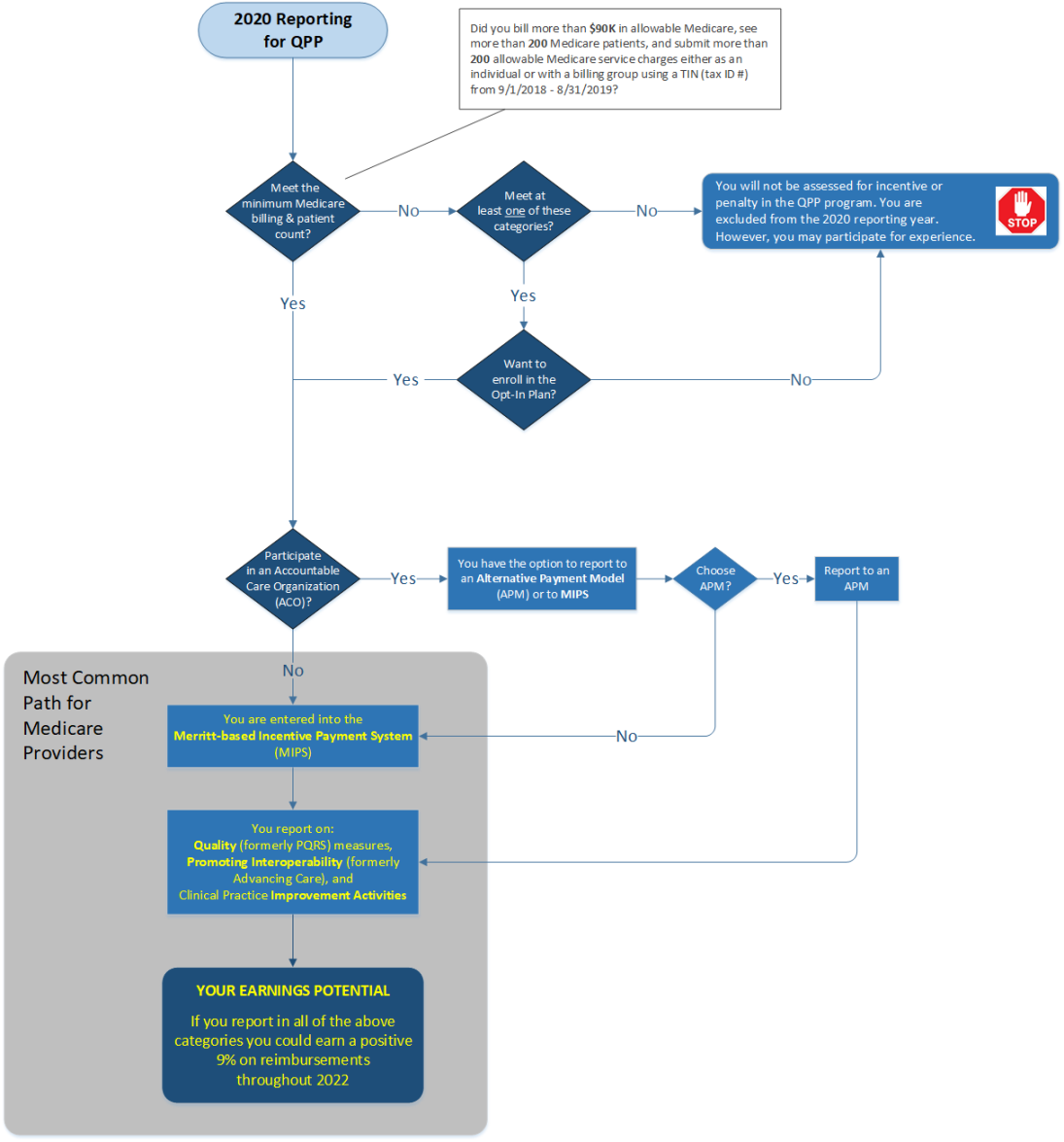

There are two sub-programs under QPP: Merit Based Incentive Payment System (MIPS) and Alternative Payment Models (APMs). The majority of chiropractic offices will be dealing with the MIPS sub-program. APM is uncommon for chiropractic businesses because it applies only to participants of Accountable Care Organizations (ACOs). Therefore, though there is a great deal of overlap between MIPS and APM from a functional perspective, for the purposes of discussion within this Online Help guide, when we talk about "QPP" we discuss QPP as it applies to MIPS functionality.

NOTE: Quality Payment Program has an official web site and ChiroTouch encourages you to visit their site and read about QPP and MIPS.

Are You Part of the Quality Payment Program?

You must participate in the Quality Payment Program if:

- You are a physician, physician assistant, nurse practitioner, clinical nurse specialist, certified registered nurse anesthetist, physical therapist, occupational therapist, speech-language therapist or pathologist, audiologist, clinical psychologist, registered dietitian, or nutritional professional, and

- You provide care for more than 200 Medicare patients per year, and

- You submit more than 200 allowable Medicare service charges per year, and

- You bill more than $90,000 in Medicare allowable per year, and

- 2024 is not your first year licensed or first year treating Medicare patients

Be advised that you are not required to participate in the Quality Payment Program if you do not meet the above conditions. However, you can still participate in this program to gain experience for future reporting. Under this circumstance, so long as you have not opted in (see below), you will not be eligible for a negative or positive payment adjustment on future Medicare earnings. You also have the option to report using ChiroTouch for positive scoring in the Quality category. Scores for submission are posted to Medicare's Physician Compare site – https://www.medicare.gov/physiciancompare/.

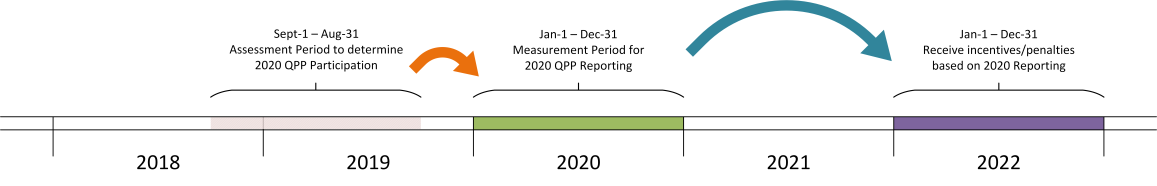

Your QPP participation will be determined by your Medicare claims filed during an Assessment Period, which for 2024 was a one-year period spanning Sept 1, 2021 through August 31, 2023. The following diagram illustrates the Assessment period, the 2024 Measurement Period, and how the resulting incentives/penalties are felt, two years ahead.

NOTE: You may find that the term Reporting Period is also commonly mentioned in reference to QPP. It is simply another way of referring to the QPP measurement period: Jan 1 - Dec 31 for each year. i.e., "reporting" is synonymous with "measurement" in this circumstance.

National Provider Identifier Lookup

CMS has provided a National Provider Identifier (NPI) Lookup for individuals and groups to find out if, based on their Assessment-Period Medicare and Medicaid claims, they fall into the Quality Payment Program.

New Opt-In Policy for the 2024 Reporting Year

CMS has introduced a new, voluntary Opt-In policy for the 2019 reporting year. If you qualify for even one of the participation requirements (over 200 Medicare patients, over $90K in billings, or the newest participation parameter, over 200 allowable Medicare service charges) you can take the opportunity to gain an incentive for positive participation.

IMPORTANT: Be aware that once you do opt in for 2024, you cannot opt out later. So, consider this commitment carefully.

The following flow chart illustrates how you will determine your requirement to participate in QPP for 2024.

QPP establishes new ways to pay physicians for caring for Medicare beneficiaries and may have an impact on your practice. This helpful guide breaks down the meanings of the rules and details your options for ensuring that you get the maximum benefit from the program.

What is MIPS?

The MIPS program combines the previous reporting programs and incentive/penalty for Meaningful Use and the Physician Quality Reporting System and introduces a new reporting aspect called Improvement Activities. For this year, each provider has the ability to choose how they will report to CMS for the incentive program. With MIPS, you can earn a payment adjustment based on evidence-based and practice-specific quality data substantiating that you provided high quality, efficient care supported by technology. Information should be submitted in the following categories:

- Quality

- Promoting Interoperability (PI)

- Improvement Activities (IA)

Quality (Formerly PQRS/G-coded claims)

What You Need to Provide: Medicare claims with G-codes listed and one outcome measure. You may also choose to report with your Clinical Quality Measures report (CQMs). CMS will accept both submissions, and CMS will apply the higher scoring submission (for each individual measure) for the possibility of earning more points. This category must be reported for a full year to avoid penalty.

IMPORTANT: Be aware that measure #131 Pain Assessment and Follow-Up has been removed from 2020 reporting options. You may continue reporting to measure #182 Functional Outcome Assessment, though it is recommended that you also actively report to Clinical Quality Measures in addition.

See the Quality section for detailed information.

The Benefit: Reporting in this category may allow providers to avoid penalty or qualify for an incentive. Reporting for a full year could result in a positive 7% payment adjustment, combined with the other reporting categories (PI and IA). A larger amount of points may be awarded based on achieving higher performance in the measure.

How ChiroTouch Helps You: Our comprehensive Macro sets let you achieve compliance with less effort. Set alerts for both staff and patients to ensure Outcome Assessments are completed in a timely manner. You can also use our Patient Sign-In tools to collect the patient subjective at the beginning of every patient visit.

Promoting Interoperability (Formerly Advancing Care)

What You Need to Provide: A minimum of 90 days of data, complete required measures, using your QPP Dashboard. Specialties may be excluded from certain measures that do not apply, but reporting measures remain the same for chiropractors. You must report at least one measure from each objective category to avoid penalty—unless exclusion(s) apply.

See the Promoting Interoperability section for detailed information.

The Benefit: 90-day reporting in this category may allow providers to avoid penalties or qualify for an incentive. Reporting for a full year could result in a positive 7% payment adjustment, combined with other programs (Quality and IA).

How ChiroTouch Helps You: Use the QPP Dashboard to report Promoting Interoperability measures. ChiroTouch offers the 2015 certified requirements (available through ChiroTouchversion 7) to enable you to achieve the maximum incentive in this category. Review the 2015 ACI measures here.

Improvement Activities

What You Need to Provide: A minimum of 90 days of data and as little as four improvement activities from the CMS list of suggested activities using your QPP Dashboard. The four improvements should fit your specialty and practice type. Make sure you verify your practice status to learn the minimum number of improvements that you are required to complete in order to avoid a penalty!

See the Improvement Activities section for detailed information.

The Benefit: Reporting on activities could result in a positive 9% payment adjustment, in combination with other programs (Quality and ACI).

How ChiroTouch Helps You: We have selected a list of 50 suggestions that are accessible through your QPP dashboard. (However, you are not limited to using just these suggestions.) You may use certain ChiroTouch features to complete some of the measures listed. Other measures are completed through tasks, policy implementation, etc. and do not require access to a certified solution. Improvement Activities will require that the provider implement a handful of CMS suggested improvements, outlined here.

Individual vs. Group Reporting

Reporting as an Individual

If you submit MIPS data to CMS as an individual, your payment adjustment will be based on your performance. An individual is defined as a single National Provider Identifier NPI tied to a single Tax Identification Number (TIN).

Reporting as a Group

A "group" is defined as a set of clinicians (identified by their NPIs) sharing a common TIN, no matter the specialty or practice site. Groups will send in group-level data for each of the three MIPS categories. If you submit your MIPS data with a group, the group will get one payment adjustment based on the group’s performance.

IMPORTANT: For Quality reporting, groups of 16 or more clinicians, i.e., "large groups", cannot use G-coded claims. Large groups must do their Quality reporting using CQMs only.

However, groups composed of 15 or fewer clinicians can use G-coded claims as well as having the option to do their Quality reporting using CQMs.

What if You Choose Not to Report in 2024?

If you fall into the QPP category described above, and at this time you choose not to report, you will be assessed for a penalty on claims two years in the future. If you are ready to get started, you can begin collecting performance data. If you are not ready at this time, you can choose to start PI and IA anytime between January 1, 2024 and October 2, 2024.

The Quality category must be reported for all twelve months of the program. If you have been billing claims with G-codes since Jan 1, 2024, you have already been reporting to this category. However, if you have not been billing with G-codes on all claims in 2024, you will need to report CQMs for the full year on your QPP dashboard.

If you choose to refrain from reporting in 2024 and submit nothing during the 2024 attestation period (Jan 1 – Mar 31, 2025) you will receive a negative 9% payment adjustment on all 2025 Medicare collections.